Finastic – The 5-Step Trading Framework Banks Use – But No One Teaches Retail Traders

$25.00 $18.00

Delivery: Within 7 days

Description

Finastic – The 5-Step Trading Framework Banks Use – But No One Teaches Retail Traders

Are you still relying on indicators and signals that seem to fail right when you need them most?

It’s not your fault. It’s the system you’ve been taught.

What if you could flip the script and finally understand how the market really works — from the perspective of the banks, hedge funds, and institutions that actually move price?

“Overview of Smart Money Concepts (SMC)” is your fast-track to seeing the market through the lens of smart money — and learning the exact 5 principles they use to trap retail traders and fuel price moves.

This isn’t another recycled “support and resistance” strategy.

This is the same logic used by the people who actually move the market — but simplified for you, the independent trader.

Whether you’re new to Smart Money or you’ve seen it online but don’t know where to start — this is your clear, structured introduction to the world of institutional trading.

What You’ll Learn In The 5-Step Trading Framework Banks Use

A complete breakdown of the 5 core pillars of Smart Money Concepts:

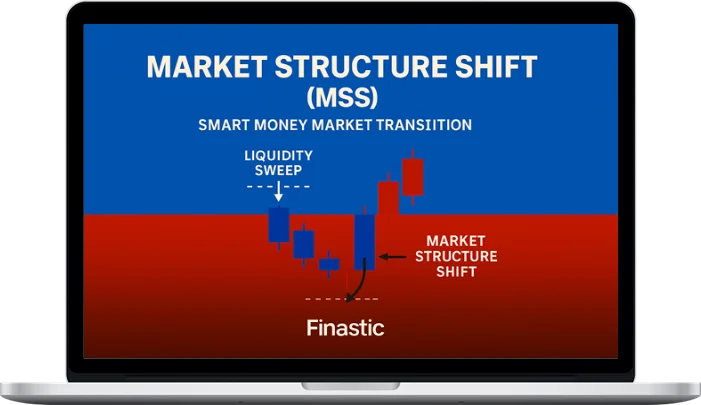

- Market Structure (HH, HL, LL, LH)

- Order Blocks (institutional demand/supply zones)

- Liquidity Grabs (stop hunts explained)

- Fair Value Gaps (where price wants to return)

- BOS & ChoCH (spotting trend shifts early)

Simple, beginner-friendly language (no fluff)

Real chart visuals so you can apply what you learn

Zero indicators — 100% price action logic

More courses from the same author: Finastic

Delivery Policy

When will I receive my course?

You will receive a link to download your course immediately or within 1 to 21 days. It depends on the product you buy, so please read the short description of the product carefully before making a purchase.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you'll receive an invitation to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

How do I check status of my order?

Please log in to TradingAZ account then go to Order Page. You will find all your orders includes number, date, status and total price.

If the status is Processing: Your course is being uploaded. Please be patient and wait for us to complete your order. If your order has multiple courses and one of them has not been updated with the download link, the status of the order is also Processing.

If the status is Completed: Your course is ready for immediate download. Click "VIEW" to view details and download the course.

Where can I find my course?

Once your order is complete, a link to download the course will automatically be sent to your email.

You can also get the download link by logging into your TradingAZ account then going to Downloads Page.

Related products

Total sold: 5

Total sold: 6

Total sold: 1